Passive Income Strategies

Financial Freedom

through passive income strategies

Start exploring today

and take the first step towards achieving financial freedom!

About Passive Income Route

Our web site is designed to provide you with the information and resources you need to start generating passive income today. Here is a summary of what you can expect to find:

– Introduction to passive income and why it’s important

– Investment strategies for generating passive income, including stocks, bonds, and real estate

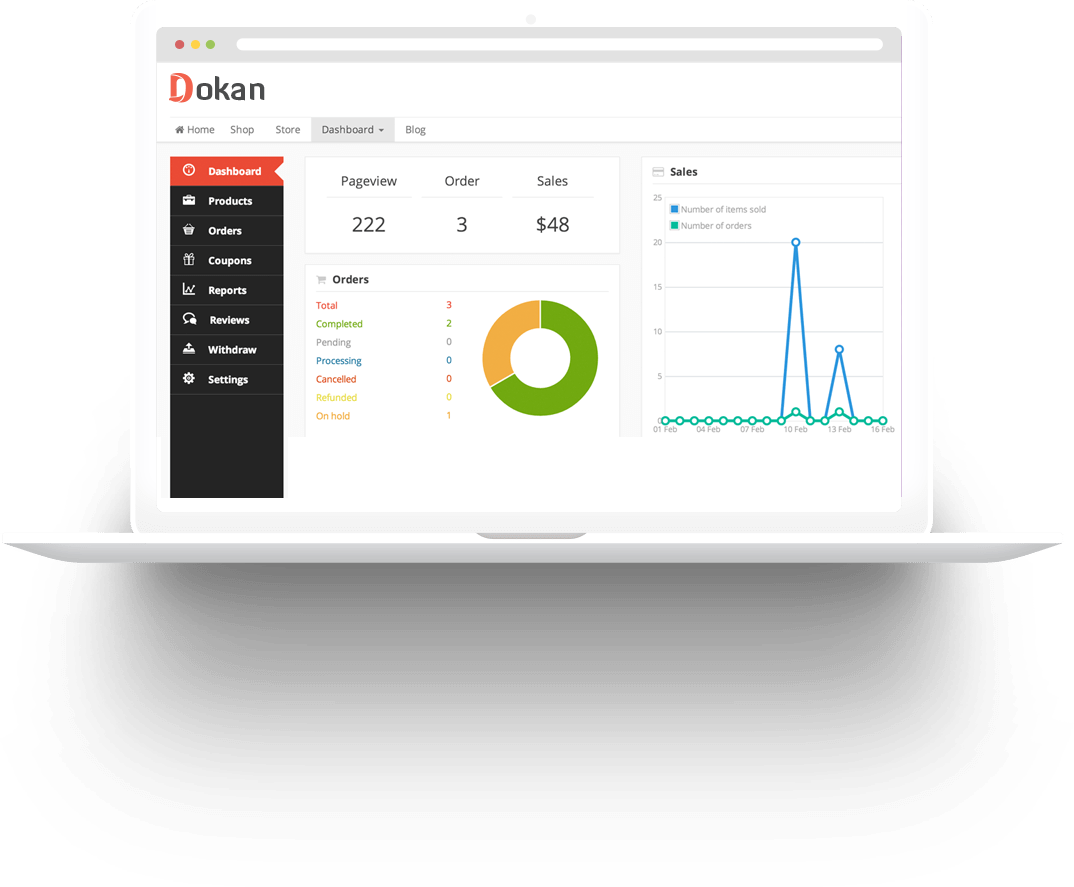

– Online business ideas, including affiliate marketing, e-commerce, and blogging

– Tips for creating passive income streams and maximizing your earnings

– Case studies and success stories of people who have achieved financial freedom through passive income

Whether you’re just starting out or you’re looking to diversify your income streams, our web site has something for everyone. Start exploring today and take the first step towards achieving financial freedom!